Financial Engineering is a multidisciplinary field drawing from finance and economics, mathematics, statistics, engineering and computational methods. The emphasis of FE & RM Part I will be on the use of simple stochastic models to price derivative securities in various asset classes including equities, fixed income, credit and mortgage-backed securities.

Coursera - Financial Engineering and Risk Management Part I (Columbia University)

WEBRip | English | MP4 | 1280 x 720 | AVC ~53 kbps | 29.970 fps

AAC | 128 Kbps | 44.1 KHz | 2 channels | Subs: English (.srt) | ~10 hours | 1.02 GB

Genre: eLearning Video / Business, Finance

We will also consider the role that some of these asset classes played during the financial crisis. A notable feature of this course will be an interview module with Emanuel Derman, the renowned ``quant'' and best-selling author of "My Life as a Quant".

We hope that students who complete the course will begin to understand the "rocket science" behind financial engineering but perhaps more importantly, we hope they will also understand the limitations of this theory in practice and why financial models should always be treated with a healthy degree of skepticism. The follow-on course FE & RM Part II will continue to develop derivatives pricing models but it will also focus on asset allocation and portfolio optimization as well as other applications of financial engineering such as real options, commodity and energy derivatives and algorithmic trading.

Syllabus

Course Overview

-An introduction to the course.

Introduction to Basic Fixed Income Securities

-Review of interest and basic fixed income securities; introduction to arbitrage pricing.

Introduction to Derivative Securities

-The mechanics of forwards, futures, swaps and options. Option pricing in the 1-period binomial model.

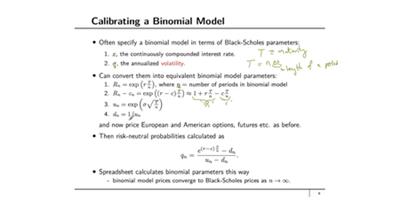

Option Pricing in the Multi-Period Binomial Model

-Derivatives pricing in the binomial model including European and American options; handling dividends; pricing forwards and futures; convergence of the binomial model to Black-Scholes.

Term Structure Models I

-Binomial lattice models of the short-rate; pricing fixed income derivative securities including caps, floors swaps and swaptions; the forward equations and elementary securities.

Term Structure Models II and Introduction to Credit Derivatives

-Calibration of term-structure models; the Black-Derman-Toy and Ho-Lee models. Limitations of term-structure models and derivatives pricing models in general. Introduction to credit-default swaps (CDS) and the pricing of CDS and defaultable bonds.

Introduction to Mortgage Mathematics and Mortgage-Backed Securities

-Basic mortgage mathematics; mechanics of mortgage-backed securities (MBS) including pass-throughs, principal-only and interest-only securities, and CMOs; pricing of MBS; MBS and the financial crisis.

Background Material

General

Complete name : 018. Pricing Forwards and Futures in the Binomial Model.mp4

Format : MPEG-4

Format profile : Base Media

Codec ID : isom (isom/iso2/avc1/mp41)

File size : 15.9 MiB

Duration : 11 min 45 s

Overall bit rate : 190 kb/s

Movie name : FERM_m_Pricing_Forwards_Futures

Album/Performer : CU_CourseraPRO

Description : This video is about FERM_m_Pricing_Forwards_Futures

Writing application : Lavf55.19.104

Video

ID : 1

Format : AVC

Format/Info : Advanced Video Codec

Format profile : Main@L3.1

Format settings : CABAC / 4 Ref Frames

Format settings, CABAC : Yes

Format settings, RefFrames : 4 frames

Codec ID : avc1

Codec ID/Info : Advanced Video Coding

Duration : 11 min 45 s

Bit rate : 53.0 kb/s

Width : 1 280 pixels

Height : 720 pixels

Display aspect ratio : 16:9

Frame rate mode : Constant

Frame rate : 29.970 (29970/1000) FPS

Color space : YUV

Chroma subsampling : 4:2:0

Bit depth : 8 bits

Scan type : Progressive

Bits/(Pixel*Frame) : 0.002

Stream size : 4.45 MiB (28%)

Writing library : x264 core 138

Encoding settings : cabac=1 / ref=3 / deblock=1:0:0 / analyse=0x1:0x111 / me=hex / subme=7 / psy=1 / psy_rd=1.00:0.00 / mixed_ref=1 / me_range=16 / chroma_me=1 / trellis=1 / 8x8dct=0 / cqm=0 / deadzone=21,11 / fast_pskip=1 / chroma_qp_offset=-2 / threads=12 / lookahead_threads=2 / sliced_threads=0 / nr=0 / decimate=1 / interlaced=0 / bluray_compat=0 / constrained_intra=0 / bframes=3 / b_pyramid=2 / b_adapt=1 / b_bias=0 / direct=1 / weightb=1 / open_gop=0 / weightp=2 / keyint=250 / keyint_min=25 / scenecut=40 / intra_refresh=0 / rc_lookahead=40 / rc=crf / mbtree=1 / crf=24.0 / qcomp=0.60 / qpmin=0 / qpmax=69 / qpstep=4 / ip_ratio=1.40 / aq=1:1.00

Language : English

Audio

ID : 2

Format : AAC

Format/Info : Advanced Audio Codec

Format profile : LC

Codec ID : mp4a-40-2

Duration : 11 min 45 s

Duration_LastFrame : -7 ms

Bit rate mode : Constant

Bit rate : 128 kb/s

Channel(s) : 2 channels

Channel positions : Front: L R

Sampling rate : 44.1 kHz

Frame rate : 43.066 FPS (1024 SPF)

Compression mode : Lossy

Stream size : 10.8 MiB (67%)

Language : English

Default : Yes

Alternate group : 1

Screenshots

Download link:Kod:rapidgator_net: https://rapidgator.net/file/ade87d205b960f40d0e443c3327cbfd1/6t68s.Coursera..Financial.Engineering.and.Risk.Management.Part.I.Columbia.University.rar.html nitroflare_com: https://nitroflare.com/view/D330C38C9783935/6t68s.Coursera..Financial.Engineering.and.Risk.Management.Part.I.Columbia.University.rarLinks are Interchangeable - No Password - Single Extraction

1 sonuçtan 1 ile 1 arası

-

27.04.2020 #1Üye

- Üyelik tarihi

- 20.08.2016

- Mesajlar

- 147.735

- Konular

- 0

- Bölümü

- Bilgisayar

- Cinsiyet

- Kadın

- Tecrübe Puanı

- 157

Coursera - Financial Engineering and Risk Management Part I (Columbia University)

Konu Bilgileri

Users Browsing this Thread

Şu an 1 kullanıcı var. (0 üye ve 1 konuk)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Alıntı

Alıntı

Konuyu Favori Sayfanıza Ekleyin