Asset Accounting in SAP

.MP4 | Video: 1280x720, 30 fps(r) | Audio: AAC, 44100 Hz, 2ch | 1.22 GB

Duration: 3 hours | Genre: eLearning | Language: English

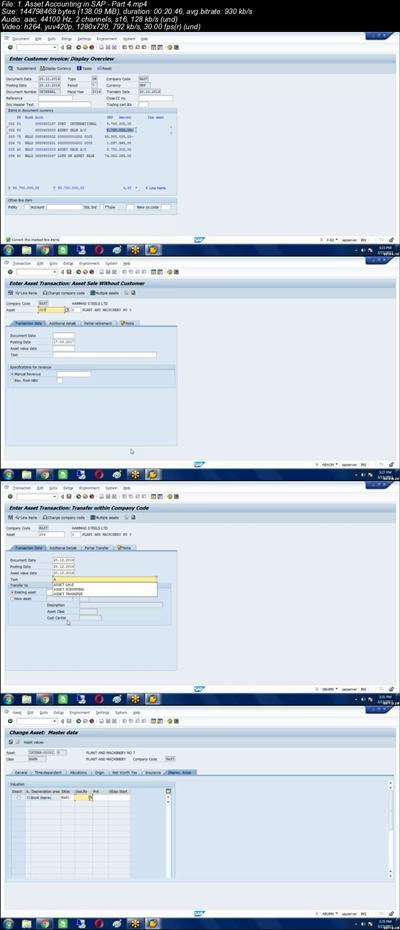

Learn the concepts of SAP Asset Accounting (FI-AA) in depth. View the implementation of Asset Accounting on SAP system.

What you'll learn

Comprehensive coverage of all topics of SAP Asset Accounting (FI-AA)

Understand the concepts of SAP Asset Accounting

Core components of FI-AA

Important configurations of FI-AA

Step-by-step demonstration of Asset Accounting on SAP system

Sale of fixed assets

Transfer, impairment, scrapping of assets

Creation of asset classes, main asset master records, sub asset master records

Become an SAP FICO Consultant

This course will help you prepare for SAP FI-CO Certification

Requirements

None

Description

Asset Accounting in SAP system (FI-AA) is primarily used for managing, supervising and monitoring fixed assets. Asset Accounting is classified as a subset of Financial Accounting and serves as a subsidiary ledger to the general ledger providing detailed information on transactions involving fixed assets.

SAP Asset Accounting is also called as sub ledger accounting and is one of the important sub-modules of SAP Financial Accounting (SAP FICO) module. The main purpose of asset accounting is to determine the exact value of the fixed assets owned by the company as on a particular date.

In SAP Accounting powered by SAP HANA only new Asset Accounting is available with new General Ledger Accounting. For you to be able to use new Asset Accounting, you need to have activated and set up the General Ledger Accounting (FI-GL) (New) application component.

Asset Accounting course content

Copy reference chart of depreciation

Assignment of chart of depreciation to company code

Creation of 0% tax codes for sales and purchases

Defining account determination

Definition of screen lay out rules

Definition of number ranges for asset master

Creation of asset classes

Integration with General Ledger & Posting rules

Defining Depreciation key

Definition of multilevel methods

Definition of period control methods

Creation of main asset master records

Creation of sub asset master records

Posting the transactions for Acquisition of fixed assets

Depreciation run and Asset explorer

Sale of fixed assets - with customer and without customer

Transfer of assets

Impairment of assets

Scrapping of assets,

Line item Settlement of assets under construction of capital work in progress

SAP FI-AA components

The important components SAP Asset Accounting are:

Basic Functions:

Master data (asset maintenance)

Basic valuation functions

Depreciation

Transactions, such as asset acquisitions and retirements

Closing operations

And more

Special Valuations: For example, for investment support and insurance

Processing leased assets

Preparations for consolidation for group financial statements

Information System

Important Configurations of SAP FI-AA

The important configurations in SAP Asset Accounting are:

How to define charts of depreciation

Define tax code on sales and purchases

How to Assign chart of depreciation to company code

How to specify account determination

How to create screen layout rules

How to Maintain asset number range intervals

How to define asset classes

How to Determine depreciation areas in asset classes

How to Specify intervals and posting rules

How to define screen layout for asset master data

Procedure to maintain screen layout for depreciation areas

how to create base methods

How to create declining balance method

How to create multilevel method

How to create depreciation key in SAP

Create asset master data in SAP

Create sub asset master data in SAP

Integration of SAP Asset Accounting with other SAP modules

Asset Accounting transfers data directly to and from other systems. As an instance, it is possible to post from the Materials Management MM component directly to Asset Accounting. When an asset is purchased or produced in-house, you can directly post the invoice receipt or goods receipt, or the withdrawal from the warehouse, to assets in the Asset Accounting component. At the same time, you can pass on depreciation and interest directly to the Financial Accounting (FI) and Controlling (CO) components. From the Plant Maintenance (PM - Plant Maintenance) component, you can settle maintenance activities that require capitalization to assets.

Who this course is for:

Anyone who wants to become an SAP Consultant or start a career in SAP

Download link:Kod:rapidgator_net: https://rapidgator.net/file/6cee170c63ce02f64581743af1b7a354/eddks.Asset.Accounting.in.SAP.part1.rar.html https://rapidgator.net/file/9e092667779b622957d8c541397925c7/eddks.Asset.Accounting.in.SAP.part2.rar.html https://rapidgator.net/file/59a957aba043c6bbe29bfaa8ea0ddf25/eddks.Asset.Accounting.in.SAP.part3.rar.html nitroflare_com: https://nitroflare.com/view/CB7AF3AD985CB07/eddks.Asset.Accounting.in.SAP.part1.rar https://nitroflare.com/view/BB5F30EE462A05E/eddks.Asset.Accounting.in.SAP.part2.rar https://nitroflare.com/view/F0C8E2B49FC4794/eddks.Asset.Accounting.in.SAP.part3.rarLinks are Interchangeable - No Password - Single Extraction

1 sonuçtan 1 ile 1 arası

Konu: Asset Accounting in SAP

-

17.09.2019 #1Üye

- Üyelik tarihi

- 20.08.2016

- Mesajlar

- 136.029

- Konular

- 0

- Bölümü

- Bilgisayar

- Cinsiyet

- Kadın

- Tecrübe Puanı

- 144

Asset Accounting in SAP

Konu Bilgileri

Users Browsing this Thread

Şu an 1 kullanıcı var. (0 üye ve 1 konuk)

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Alıntı

Alıntı

Konuyu Favori Sayfanıza Ekleyin